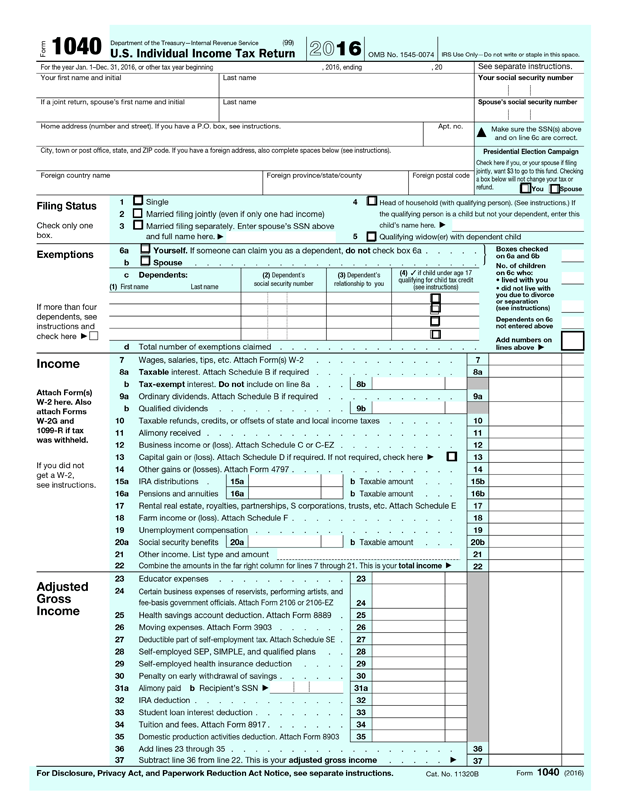

On line 11 of the tax year 2022 Form 1040, you will report your AGI. Your AGI is an important number since many credits and deduction limitations are affected by it. One of the first steps is to calculate Adjusted Gross Income (AGI) by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. Form 1040-X: This form is for taxpayers who need to make amendments to their tax return after previously filing a Form 1040.

Form 1040-NR: This form is for non-resident aliens, and it's several pages longer than the other 1040 form versions.Form 1040-SR is nearly identical to Form 1040, but is printed using a larger font and includes a chart for determining the taxpayer's standard deduction. Form 1040-SR: This version is for senior taxpayers (age 65 and older).Form 1040: This is the one the majority of taxpayers will use to report income and determine their tax for the year and any refund or additional tax owed.There are now four variations of the 1040 form (1040A and 1040EZ no longer exist): Why are there different versions of the 1040 form? Download the 1040 form to begin preparing your tax documents. Here's a guide to all of the 1040 variations you may come across.

Depending on the type of income you need to report, it may be necessary to attach additional forms, also known as schedules. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. taxpayers use to file their annual income tax return. The IRS 1040 form is one of the official documents that U.S.

0 kommentar(er)

0 kommentar(er)